Dir.: Justin Pemberton; Co-Dir.: Thomas Piketty; Doc with Rana Foroohar, Professor Joseph Stiglitz, Thomas Piketty, Ian Bremmer, Francis Fukuyama; France/New Zealand 2019, 102′

Justin Pemberton makes economics anything but dry in his thrilling – and frightening – screen adjunct to Thomas Piketty’s ground-breaking book. Brisk and entertaining like a filmic history lesson, some 400 years are condensed into a palatable mouthful that lacks somehow the depth of the page.

The New-Zealander has raided the archives enlivening Capital in the 21st Century with TV clips as well as graphics and archive footage of newsreels, financial ‘experts’ adding their pennyworth in a bid to clarify the mess we are in. According to Piketty – who also appears as a talking head – nothing has changed since the 17th century when feudalism ruled and the medium life expectancy was seventeen. So what does that tell you?

Feudalism saw one per cent of the population own seventy percent of land. Back then the only way of earning a living (apart from servitude) was itinerant farm work. In films terms, the world was like just like Elysium (2013), where a charmed few lived in splendour and the rest in grinding poverty. The French Revolution tried to break the mould but the real change came with the Industrial Revolution in the 19th century when machines took over the manual work but the power structure was the same: workers being in hock to their employers (who took all the risks), strikers ending up in jail.

Many Europeans emigrating to North America for a new start soon discovered that hard land-based work was still the order of the day, the small family unit unable to compete with land-owners, who bought in slaves and exploited them on the cotton fields of the Deep South. Meanwhile Europeans were out colonising and exploiting the natural resources of the newfound territories, finding unchallenged markets for their products and building fortunes and empires into the bargain. ,

European workers’ resentment increased between 1870 and 1914, while an emerging Middle Class got used to a new term: fashion. In the US meanwhile, the class struggle was much more vicious, employers hiring their own militia, backed by a Federal Army who quelled many strikes. The outbreak of World War I channelled class envy into a national identity, the aftermath saw the suffragettes making inroads into male dominance with their fight for the right to vote.

Pemberton then leads us through the more erratic midsection of the documentary which deals with the 20th domination by banking power, nationalism, Depression, war, the welfare system and workers rights. Working class lives improved immeasurably during the late 1950s when prime minister Harold Macmillan proclaimed: “You’ve never had it so good”. He was probably right. The establishment of a Welfare State led to a vigorous middle class which would become the backbone of society, but that backbone has since been severely tested by an erosion of values that has polarised society, particularly now as the gulf widens again between rich and poor. Since the 1970s Oil Crisis, middle class income has sharply declined in the US, where ‘stagflation’ soon became the order of the day.

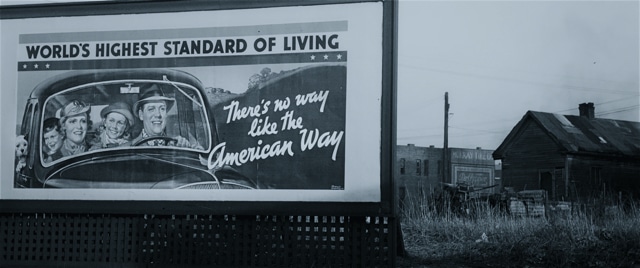

In the 1980s, President Reagan dismantled the welfare state, and Wall Street and Main Street diverged: what was good for the City and the big corporations (with Joseph Stiglitz’s ideas of trickle down economics) was not seen as a benefit to Main Street with its mainly family-owned small businesses. The US was suffering from competition from Japan and Europe, and Reagan’s battle cry “to make America great again” created a war against trade unions, and native workers disgruntled by a growing number of immigrant labourers. With the slogans like “Greed is good” dominating, more deregulation was supposed to facilitate a “trickle down” of wealth, which never happened. The result is that the bottom 90% of the population has suffered a loss in family income, and the real wages (purchasing power) are on a level last experienced in 1960.

The credit boom, another contributing factor of the 2008 crash, camouflaged a dire situation: since 1970 wages have increased for 90% of the population by 800%, but for the top ten percent the increase in capital was 2000%. This has led to the Super Rich not re-investing their capital in production, but in keeping their wealth in an endless loop, where the same people buy and sell capital commodities, bringing a 4.5% average return. This compared with 1.6% return on investments in industry or other productive enterprises.

When all is said and done, the super rich will always be able to employ the best legal advice to fight their way out of taxation. In 2015, Google Alphabet had made a profit of 15.5. billion USD – offshore in Bermuda. shell companies and numbered accounts for the Elite keep them free from punitive taxes.

Meanwhile, new technologies create new jobs. More than ever ,individuals are setting up companies and gaining financial freedom and clout. But when robots replace humans, humans will slide down the pecking order. Vehicle drivers now make up the second largest group of people in employment. With the advent of the driverless car, what will eventually happen to them?

So the outlook is grim. But it always was. The rich will always be rich, and the poor will always be poor, but the disadvantaged have more opportunities that ever before. Pemberton includes a psychology experiment that exposes a sinister side to human nature suggestive of a positive mind set that also comes into play.

The consequences can only be controlled politically. But who will be controlling capitalism? Certainly not the middle classes, if their erosion continues. The film tries to end on a positive note: “Creating a more equal society is possible from a technical standpoint”. But in reality we all know this is unlikely to happen due to the inherent flaws of human nature. AS

NOW ON PRIME VIDEO